JurisTax’s Partnership with LIVERIA Simplifying Company Setup for Foreign Investors in Mauritius

JurisTax, a leading financial services company in Mauritius, specializes in advisory and structuring, company formation, and corporate and accounting services. We are dedicated to facilitating a crucial aspect of property acquisition in Mauritius for foreign investors: the establishment of a company. In partnership with LIVERIA, an exclusive real estate brokerage, we provide seamless solutions for investors, simplifying the process of purchasing property through a company. Our clients benefit from expert advice and a comprehensive, step-by-step approach, ensuring a smooth and efficient experience in their property investment journey.

Why Set Up a Company to Buy Property in Mauritius?

Mauritius has emerged as one of the top destinations for foreign property investments due to its favourable business environment, political stability, and beautiful landscapes. Many investors opt to purchase through a company, particularly those looking to invest in high-end properties.

Key benefits of buying property through a company in Mauritius include:

Tax Efficiency: Mauritius offers an attractive corporate tax regime, including a low corporate tax rate of 15% and a network of double-taxation treaties. Structuring property ownership through a company can yield significant tax benefits.

Ease of Ownership Transfer: A company structure allows for easier property ownership transfers, whether to family members or other parties, by selling shares rather than the property itself.

Inheritance Simplified: One of the most significant advantages of owning property through a company is that inheritance becomes far more straightforward. Instead of dealing with complicated succession laws, property is passed on through the transfer of shares. As an individual, passing on property can involve more complex legal processes and taxes. Through a company, the ownership transition is more streamlined and cost-effective.

Protection of Assets: Holding property under a company can safeguard personal assets and limit liability.

Residency Opportunities: Setting up a company in Mauritius allows multiple partners or friends to invest and qualify for residency. By pooling investments—each contributing at least USD 375,000—a group can co-own a luxurious villa and secure residency for all investors. This approach offers the benefit of shared ownership while granting residency to each party.

Steps to Set Up a Company in Mauritius

Setting up a company in Mauritius as a foreigner is a straightforward process, especially with the right guidance. With JurisTax by your side, you can follow these steps to ensure a smooth experience:

1. Choose the Type of Company:

I. Domestic Company

A Domestic Company is a company which is resident in Mauritius and allows to conduct business with resident and non-resident of Mauritius.

Common uses:

Trading

Investment Holding, including holding immovable property

Consulting Services, amongst others.

Key Features:

Corporate tax at 15%

Companies engage in the export of goods; the corporate tax is at 3%

A partial exemption regime of 80% on certain types of income

No withholding tax on dividends declared by domestic company

No capital gain tax in Mauritius in the event of the disposal of investments

No inheritance taxes

No exchange control for the transfer of capital and gains to the country of residence of the shareholders

Corporate Social Responsibility (CSR): 2% of chargeable income of the preceding year

Value-added tax (VAT) is a tax on goods and services: 15%

Corporate Climate Responsibility Levy, equivalent to 2% of the company’s profits, will be imposed on companies with a turnover exceeding MUR 50 million (approximately USD 1 million).

II. Trust

A Trust is one of the most flexible instruments available in the financial services landscape. It is based on a fiduciary relationship arising from the distinction between a person who, at law, holds the title to property (Legal owner) and the one or the ones who are beneficially entitled to it (beneficiaries).

Under a Trust, the legal title will be vested in the Trustees and the beneficial/ equitable interest in the beneficiaries under the Trust.

Common uses:

Asset Protection

Estate and Succession Planning

Protection from forced heirship rules

Holding of Investments and Property

Investment Funds

Charitable & Philanthropic Purposes

III. Société civile immobilière/ Civil Partnership

The civil partnership is a legal framework that is created to purchase, hold and manage real estate properties. It is commonly used for the purchase of real estate properties to anticipate for the global transmission to children. There is the classic split ownership between usufruct and bare ownership.

2. Prepare Documentation:

You’ll need to submit key documents such as:

A detailed business plan

Certified copies of passports

Proof of address

Bank reference letters

3. Company Registration:

With the help of JurisTax, the company is registered with the Registrar of Companies in Mauritius. You’ll also need to open a bank account in the company’s name.

4. Obtain Licenses:

Depending on the company’s activities, you may need to apply for special licenses. For real estate investments, this often includes applications with the Economic Development Board (EDB) for permission to buy property. LIVERIA and JurisTax will assist you throught the process.

5. Comply with Ongoing Requirements:

Once the company is established, it must maintain compliance by filing annual financial statements, conducting audits, and paying applicable taxes.

Why Choose JurisTax for Your Company Setup?

JurisTax expertise in corporate structuring and in-depth knowledge of Mauritian law and global legislation, help handle every step of the process—from company formation to compliance—ensuring that our clients enjoy a stress-free experience. With our combined services with LIVERIA, you can focus on your investment opportunities while leaving the complexities of setting up your business to the experts.

Key Advantages of JurisTax:

Expert Guidance: JurisTax has years of experience in helping foreign investors navigate Mauritian laws and tax structures.

Efficient Process: JurisTax ensures the swift establishment of your company through streamlined processes and a team of specialists.

Tailored Solutions: Every client is unique, and JurisTax provides personalized advice based on your specific investment goals and circumstances.

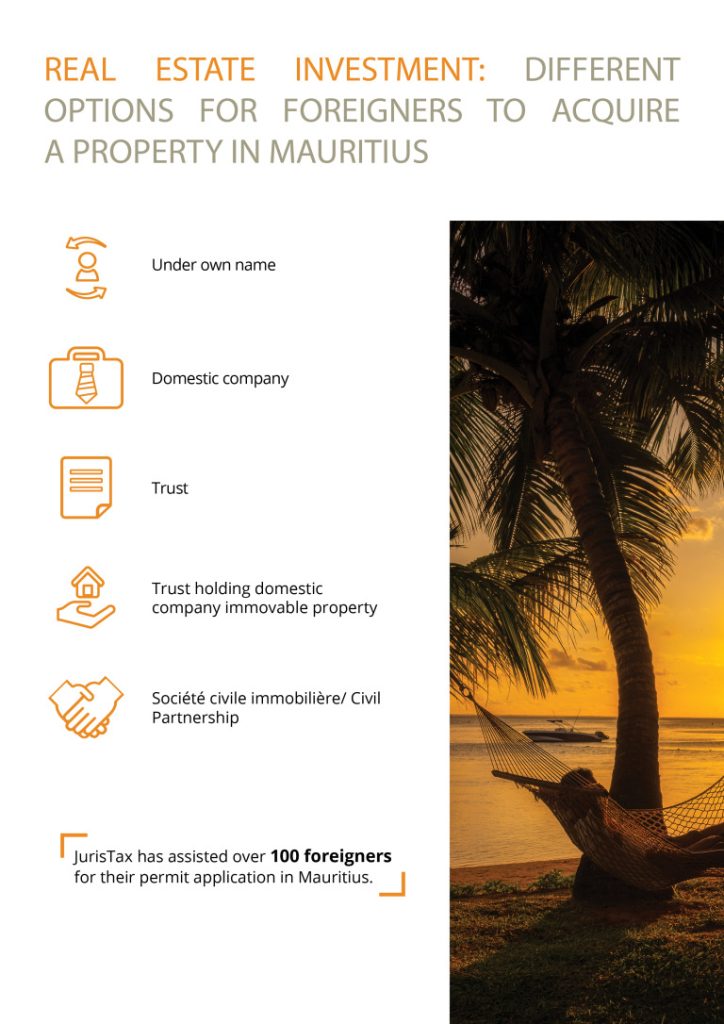

Options for Foreign Investors to Buy Property Through a Company

As a foreign investor, Mauritius offers a range of property options through structured schemes, such as:

Integrated Resort Scheme (IRS)

Property Development Scheme (PDS)

Smart City Scheme

Ground+2 Apartments

LIVERIA guide you in finding the perfect property that aligns with your investment goals while ensuring full compliance with all legal requirements.

Conclusion

By setting up a company in Mauritius, you ensure compliance with local property laws and unlock numerous financial and tax benefits. While LIVERIA is dedicated to helping you navigate the real estate market with ease, JurisTax provide comprehensive solutions for foreign investors, from setting up a company to managing the legalities of property ownership”.

If you’re ready to invest in Mauritius’s thriving property market, contact us today to explore your company formation and acquisition options.

Contact us now for a consultation and take the first step towards making Mauritius your investment destination.

You can check article here: LIVERIA’s Partnership with JurisTax: Simplifying Company Setup for Foreign Investors in Mauritius – LIVERIA International Realty

For more information please reach out to us on contact@juristax.com