Summary of Union Budget of India 2025-26

Foreword

As India advances towards its vision of Viksit Bharat 2047, the Union Budget 2025-26 emerges as a critical policy instrument designed to promote sustainable growth, strengthen fiscal resilience, and establish a supportive environment for both individuals and businesses alike.

The Finance Minister also announced the forthcoming New Tax Bill, which aims to adopt a “trust first, scrutinize later” approach. The new legislation will be significantly shorter, reducing its complexity and providing greater tax certainty for taxpayers. This move is expected to simplify compliance and reduce litigation.

In conclusion, the Union Budget 2025 lays the groundwork for sustained economic growth, providing businesses with a range of opportunities to adapt, innovate, and scale in line with the government’s strategic vision.

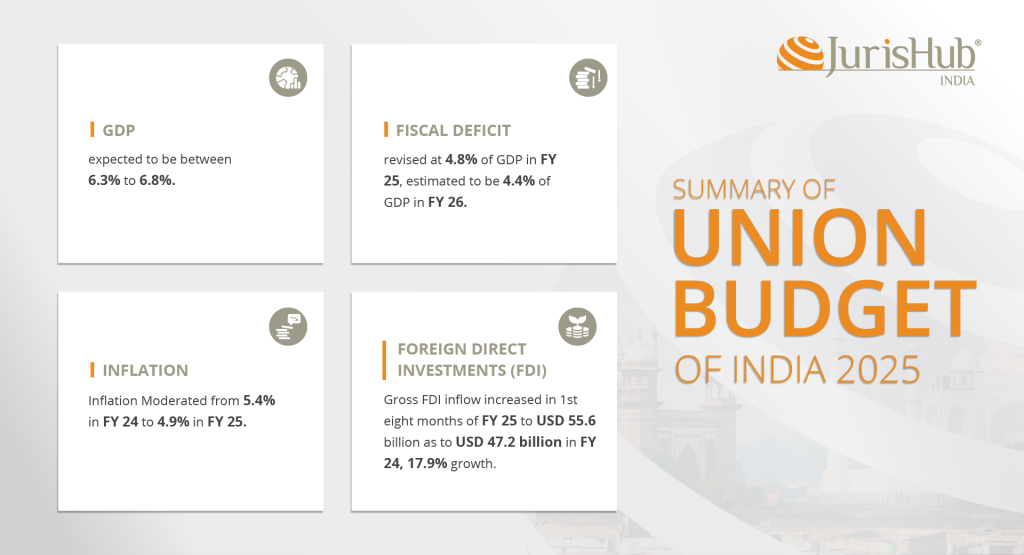

Economic Indicators

This year’s budget outlines transformative reforms in six critical domains which are:

Taxation

Power Sector

Urban Development

Mining

Financial Sector

Regulatory Reforms

KEY DIRECT TAX PROPOSALS

- New Income Tax Bill: Finance Minister announced that the New Income-tax bill will be released for discussion in the coming week.

- Personal Tax reforms: Resident individuals will now have Zero tax liability on taxable income (excluding certain special incomes) up to INR 12 lakhs, up from the previous limit of INR 7 lakhs. Tax savings up to a maximum of INR 1.10 lakhs.

- Other benefits include exemptions and deductions under National Pension Scheme (NPS) and National Savings Scheme (NSS) and perquisite limits of employees.

- Corporate Tax Rate: Corporate tax rates for domestic as well as foreign entities remain unchanged.

- Harmonisation of Significant Economic presence for Transactions or activities of Non-residents in India.

- Presumptive Taxation for entities engaged in electronic system design and manufacturing business, 25% of the gross receipts will be treated as profits from the business, which in turn will result in an effective tax rate of 9.56% on gross receipts.

- Tax on Business Trust: Long-term capital gains on equity shares or units of equity-oriented funds or units of a business trust shall be taxable at special rates (12.5%) as against Maximum Marginal Rate (MMR).

- Incentives for Inland Transportation: Tonnage Taxation scheme would be applicable to Inland transportation

- Various Tax Incentives to the International Financial Services Centre (IFSC):

- The sunset date for the commencement of operations in IFSC to avail exemptions and deductions has been extended to March 31, 2030.

- Exemptions on dividends received by units in IFSC from IFSC companies have been expanded to include ship leasing businesses, which was previously limited to aircraft leasing.

- Exemption from capital gains on the relocation of offshore funds to IFSC has now been extended to include retail schemes and Exchange-Traded Funds (ETFs).

- Exemption for non-residents on gains or income from offshore derivative instruments has been extended to transactions entered into with FPIs, a privilege that was earlier limited to offshore banking units.

- Simplification, Rationalization, and Other Significant Measures:

- The carry forward of accumulated losses will be limited to eight assessment years, starting from the year the loss was first computed for the original predecessor entity.

- A uniform tax rate of 12.5% will apply to long-term capital gains arising from FPIs and other specified funds.

- Extension of the time limit to file updated returns has been extended from 24 months to 48 months from the end of the relevant assessment year, unless a show-cause notice for income escaping assessment has been issued.

- Sunset date for the incorporation of start-ups eligible for claiming tax holiday is proposed to be extended to March 31, 2030, from March 31, 2025.

- To reduce the compliance burden for small charitable trusts and institutions, the period of registration has been increased from 5 years to 10 years.

- Expansion of definition of virtual digital assets

- Definition of capital assets amended to include for AIFs

Tax Deduction and Collection at Source (TDS/TCS)

- TDS (Tax Deducted at Source) on rent increased to ₹6 lakh from ₹2.4 lakh.

- Remove TCS (Tax Collected at Source) on remittances for education purposes if the remittance is funded through a loan taken from a specified financial institution.

- Threshold for TCS on remittances under the RBI’s Liberalised Remittance Scheme (LRS) has been increased from ₹7 lakh to ₹10 lakh.

- It is proposed that higher TDS/TCS rates be removed for non-filers of income tax returns.

- Transfer Pricing: Rationalising transfer pricing assessments by allowing the Arm’s Length Price (ALP) determined for a transaction in one year to apply to similar transactions for the next two years.

KEY INDIRECT TAX PROPOSALS

Goods and Service Tax (GST)

- Track and trace mechanism for specified commodities (for instance, tobacco products, pan masala, etc.), along with penal provision for non compliance.

- Taxability of Vouchers: Provisions relating to Time of Supply with respect to vouchers have been omitted.

- Supply of goods warehoused in a Special Economic Zone (‘SEZ’)/Free Trade Warehousing Zone (‘FTWZ’) shall be outside the levy of GST, no refund of taxes, if any, will be allowed on such transactions before insertion of said clause.

Customs Duty

- The Government has rationalized the custom duty rates by reducing 15 tariff rates to 8 effective tariff rates including a zero rate.

- The Basic Customs duty (BCD) on few important commodities is decreased.

Commodity | Old Rates | New rates |

Decrease in Tariff Rate (w.e.f. 01 May 2025) | ||

Solar Cells, solar modules and other semiconductor devices | Various | 20% |

Motor Vehicles, Yachts and other vessels | Various | 20% |

Motor cars and motor vehicles for the transport of persons | Various | 70% |

- From 2 February 2025, BCD on many items dropped to nil or significantly lower rates, aiming to promote industry growth and reduce import costs. Key BCD reductions include aquafarming products, leather, metals, IT and electronics components, Motor Cars and toys, Six life-saving key medicines.

- Cessation of Settlement Commission from 1 April 2025 for Customs and Excise matters and an Interim Board shall be set up for settlement of pending applications.

OTHER MATTERS

- Foreign Direct Investment (FDI) in insurance for firms which invest entire premium in India raise from 74 percent to 100 percent.

- On Ease of Doing Business, the government plans to develop a modern, people-friendly, and trust-based regulatory framework.

- Ensuring faster approvals for company mergers and expand the scope of related regulations.

- Additionally, the government will enhance the investment and turnover limits for MSMEs, increasing them by 5 times and 2 times, respectively, to boost their growth and operational efficiency.

- New schemes for toy manufacturing sector were proposed.

- Greenfield airports will also be developed in Bihar to further enhance connectivity.

Concluding Remarks

The Union Budget 2025-26 brings much-needed tax relief to individual taxpayers while ensuring that compliance remains simple and fair. With a focus on inclusive growth, investment-driven expansion, and digital transformation, the Economic Survey 2025 sets the stage for India’s economic ambitions in the coming decade. Strengthening climate resilience, AI-driven productivity, and deeper global integration will be key to India’s next growth phase.